In times of economic uncertainty, effective capital management is crucial. Virtual cards are a powerful tool for businesses to manage costs effectively. Their flexibility allows for tighter control of expenditure, enabling businesses to monitor and regulate spending more efficiently. However, whilst virtual cards offer significant advantages, they traditionally present some operational challenges when managing large volumes of cards and the associated funds movements.

To help businesses eliminate the operational effort of managing multiple cards and the respective funding complexities, we’ve developed an innovative new model: Lean Funding.

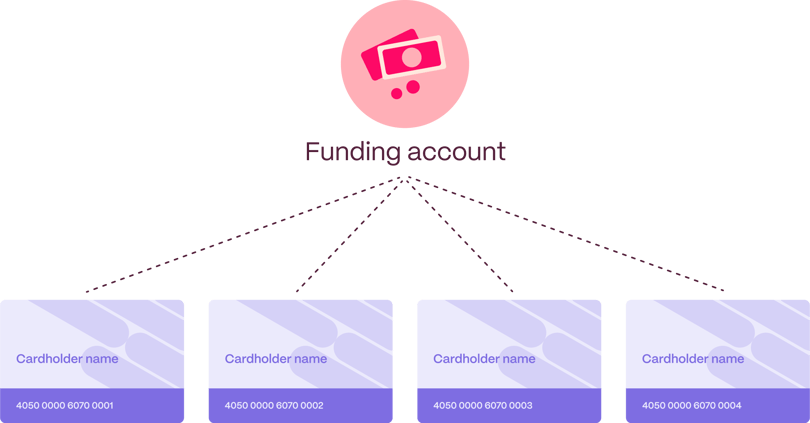

With Lean Funding, funds are pooled and centralised in a single account, which cardholders can transact against seamlessly and concurrently. This model removes the need to fund cards individually, as well as collect unspent amounts. Ultimately, Lean Funding is designed to provide greater operational efficiencies and improve cashflow management for businesses.

Businesses face a challenging operating environment

In today's dynamic environment, businesses deal with multifaceted challenges, from rising inflation to economic turbulence. Supplier payments, payouts, and expense management solutions are therefore being closely scrutinised, as they are often manual and costly business operations.

Managing corporate payments typically involves navigating administrative complexities and detailed reconciliation. So, the need to streamline operations, combined with the mounting pressure to reduce costs, has prompted businesses to seek smarter, more efficient, and secure ways to make payments.

Virtual cards can help businesses deal with the current market situation

The use of virtual cards has expanded across multiple industries, facilitating greater control, security and convenience for corporate payments.

The adoption of virtual cards by businesses has been steadily increasing with Juniper Research forecasting virtual card transactions to increase by 388% globally by 2028, driven by API driven virtual card issuing platforms.

Managing high volumes of virtual card payments is complex

While the adoption of virtual cards has surged, many businesses encounter operational challenges when managing virtual card payments at scale.

In typical funding models, teams have to pre-fund the individual virtual cards, so that cardholders have funds available to make purchases. This means that each card needs separate account management, funding, and balance management. When operating at scale, this model quickly becomes costly and ties up significant capital, as each card has been prefunded often well in advance of its use.

Other, more recently launched funding models have made steps toward improving efficiency, enabling businesses to skip pre-funding cards by transferring funds only at the time of purchase. Yet, these models still require a funds transfer between funding accounts and the associated cards, creating contention risks and the complexity of collecting unspent funds.

This is why we are introducing Lean Funding

A modern solution designed to streamline the management of virtual card payments for businesses, through an efficient funds flow. The Lean Funding model centralises funds by loading them into a single funding account, enabling cardholders to transact concurrently from that balance in real time. This means that the virtual cards will never hold a balance.

By eliminating the need for individual funds transfers to each card, businesses save on processing fees, and perhaps more importantly, as capital is no longer tied up across multiple cards, more liquidity is available to business to be invested in revenue generating activities.

Ultimately, operating and managing a consolidated funding account means that businesses gain overall better control of their cash flow, which is key in such a turbulent economic landscape.

What are the benefits of Lean Funding for businesses?

Improved liquidity management

To help businesses gain greater control over their finances, we have built Lean Funding so that funds are held in a single account, simplifying transactions. This model eliminates the need to make individual transfers to distribute funds across multiple cards.

By centralizing funds, businesses can effectively allocate resources, without the complexities of managing different cards. Lean Funding helps businesses optimise the available capital, for a more robust financial foundation.

Simplified monitoring and forecasting

Pooling funds within a single funding account offers businesses a clear advantage for monitoring and forecasting. Organisations get full visibility of account balance and activity, facilitating accurate forecasting and strategic decision-making. With all financial information easily accessible, businesses can efficiently monitor their cash flow, identify trends, and make informed projections, fostering better financial planning and management.

Streamlined processes

Consolidating funds in a single account means cutting down on internal transfers. With fewer transactions to make, businesses can save on operational costs. Moreover, since there are no residual funds spread across multiple cards, there's no need to manage or claim the remaining amounts. This simplifies financial operations by eliminating unnecessary transfers and administrative tasks.

How will Lean Funding work for cardholders?

Switching to, or adopting, the Lean Funding model won't disrupt the user experience. Cardholders will continue making purchases as usual and have access to the relevant transaction history. From a business standpoint, the transition to Lean Funding is a seamless process, which gives businesses all the benefits mentioned previously while streamlining operations.

This change is geared towards enhancing efficiency behind the scenes without altering the user-facing functionalities, ensuring a smooth and uninterrupted experience for cardholders.

In conclusion, Lean Funding isn't just a feature. It's a game-changer in the realm of corporate payments, bringing efficiency in transaction processing and scalability.

It empowers businesses to overcome the complexities associated with managing virtual card payments, offering a streamlined, cost-effective, and secure alternative. At Edenred Payment Solutions, we're committed to driving innovation that transforms the financial landscape and empowers businesses to thrive in a rapidly evolving economy. Lean Funding is the smarter way forward, revolutionising corporate payments one transaction at a time.

Discover more about Lean Funding

Want to find out more about Lean Funding and how we can help you? Contact us today

.jpg?height=418&name=pexels-karolina-grabowska-4968391%20(1).jpg)