DIGITAL BANKING

Powering fintech innovation

Design personalised payment experiences with our e-money accounts, payments, cards, processing, and end-to-end compliance support.

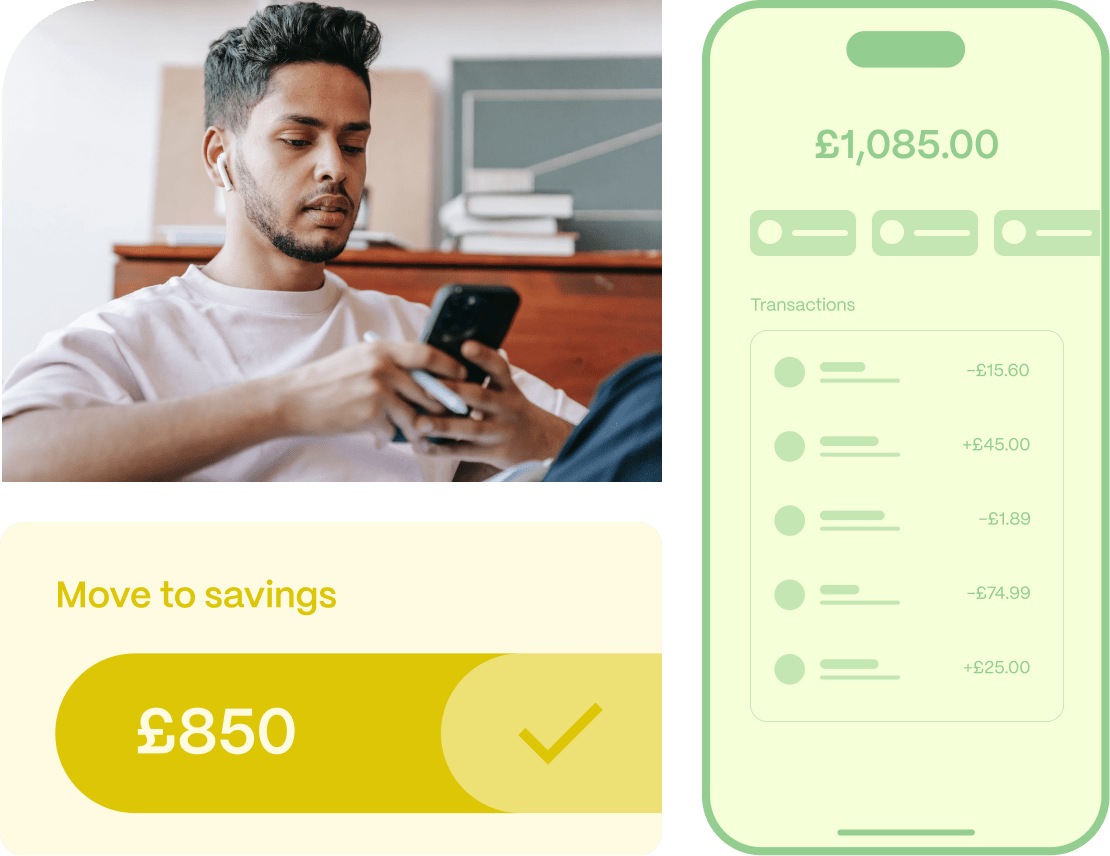

Deliver modern fintech experiences

Offer secure and compliant e-money accounts

Power your product with the support of a trusted payment solutions provider.

- Deliver an alternative banking experience through UK / EU e-money accounts and IBANs, with payment features that seamlessly integrate into your digital offering.

- Help users streamline finances with Mastercard® physical and virtual expense cards that can be tokenised for digital wallets.

- Easily integrate the functionalities you need with our real-time, flexible, and compliant APIs, accessing an ecosystem of payment schemes, including Faster Payments and SEPA.

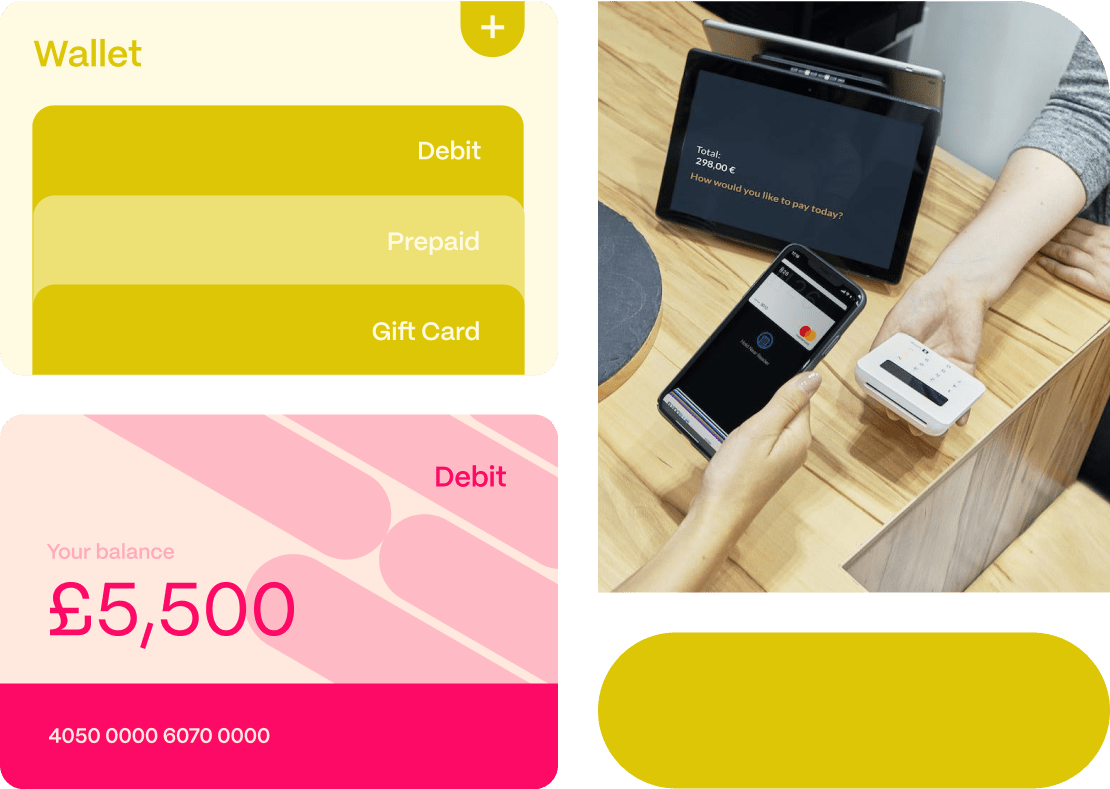

Grow and scale your business with our flexible models

Design a tailored program with our customisable solutions for multiple business models.

- Whether you cater to a business audience or have a consumer-focused solution, we can support your product needs.

- We empower regulated institutions with processing and card issuing. For low-risk programs, we offer comprehensive licensing support.

- Our highly adaptable solutions are designed to meet unique needs with advanced customisation, and smooth integration with existing banking infrastructure.

Go-to-market with confidence

Rely on 20+ years of payment experience, a secure platform, and a team of dedicated product and compliance experts to scale your program.

- Launch and expand your offering with our expert knowledge of regulatory requirements across multiple EU jurisdictions.

- Deliver reliable payment experiences to your users with our robust, highly-available payment processing platform.

- Our payments infrastructure is PCI DSS certified, and complies with GDPR to ensure top-notch security.

The team has wide-ranging experience and expertise across products and project management, and being part of the wider Edenred group ensures that we have a stable and reliable platform – which has 99.99% uptime. We need this dependability as we look to scale our existing offerings and expand into new product and market segments.

Michael Aldred

CEO, thinkmoney