Design the right experience for users

Payouts

Make convenient payouts to your users with virtual cards that are instantly generated, fully configurable, and can even be embedded within payment flows.

Expense management

Cut manual processes, and simplify reimbursements, with card programs designed for business finances, from employee expenses to supplier payments.

Deferred payments

Provide access to flexible forms of credit through physical and virtual cards that ensure seamless transactions across multiple channels.

The collaboration with Edenred Payment Solutions was simple and efficient, allowing for seamless integration of their virtual payment card within Ayruu for supplier payment. This integration has made it possible to enrich and optimise our features in terms of booking payment, thus contributing to an even smoother experience for businesses.

Sandrine Wu Jye

Co-founder, Ayruu

Power payment experiences with our configurable building blocks

BIN sponsorship

Streamline your go-to-market strategy with flexible BIN sponsorship solutions, providing direct access to global card schemes (Mastercard® and Visa). We offer shared or dedicated options for a range of BIN types including prepaid, debit or credit programs.

Issue branded physical cards

Customise physical cards with your branding, logo, and your preferred card material, so customers engage with your brand every time they use their card. Choose your own vendor for card fulfilment, or partner with our trusted manufactures to cut project implementation time by up to 10 weeks.

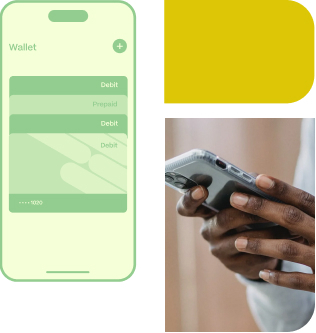

Flexible virtual cards

Our APIs support instant virtual card generation, complete with 16-digit PAN, expiry and CVC2 data, enabling users to make payments immediately. Whether cards are single use or reloadable, our clients get full control over where, when and how they can be used.

Support for digital wallets

Enable users to enrol cards within digital wallets, such as Apple Pay, Google Pay, and Mastercard Click to Pay, with our APIs. We manage the end-to-end tokenisation process, ensuring configuration and testing is completed according to mobile and scheme providers’ guidelines.

Versatile cashload capabilities

Enable your cardholders to deposit cash into their accounts at PayPoint terminals or at 11,500 Post Offices across the UK. All transactions are authorised and auto-cleared by our robust and reliable system, providing access to funds immediately.

Secure card transactions

Card issued support 3DS (Three-Domain Secure) to enable secure online transactions and comply with Strong Customer Authentication (SCA) and PSD2 regulations through in-app authentication.

Card programs adapted to your industry

As a PCI DSS compliant card issuer, with a robust in-house payment platform, we have all the credentials to support innovative card programs across a range of industries.

- Insurance: We empower insurers and assistance firms to embed virtual cards into their claims payout process to provide a seamless and convenient experience to policyholders.

- Corporate: We help design structured and controlled card programs for business payments that simplify operations for finance teams.

- Buy Now Pay Later: Our core payment technology enables fintechs to offer POS lending and deferred payment products for in-store and online transactions.

Everything you need to know about our card issuing capabilities in 20 seconds

Build a card program that suits your business needs

Card issuing

In this comprehensive model, we provide everything you need to launch a fully compliant card program. This includes the licenses, BIN sponsorship, and regulatory support. You’ll operate under our e-money licence using an Agent model, while we take care of the full card lifecycle, maintain the balance ledger, and authorise transactions.

If you need more flexibility, you can also add your own custom controls through our API using the Delegated Authorisation feature.

Card processing

Simplify your card operations with our powerful in-house payment platform. We take the technical complexity out of the equation, so you can focus on delivering a seamless experience for your users.

With this model, you’ll keep full regulatory control of your program – including balance management and authorisation checks, while we handle the heavy lifting for the tech behind the scenes.

Learn more

Card issuing + e-money accounts

Complement your card solution with fully compliant e-money accounts, which are connected to a broad range of payment schemes that you can integrate based on your business needs.

This combined offering enables users to spend, send, receive, and hold funds easily from your platform.

Learn more

Build in partnership with an industry leader

£35bn+

transaction value processed in 2022

500+

in-house payment experts

20+

years of industry experience

Frequently asked questions

What is card issuing and who needs it?

Card issuing is the process of creating and distributing payment cards (physical or virtual) that allow users to make transactions. Fintechs, enterprises, insurers, and BNPL providers typically need card issuing solutions when they want to offer branded payment experiences to their customers, without building the infrastructure themselves. Edenred Payment Solutions provides end-to-end card issuing services with flexible BIN sponsorship options, enabling businesses to launch compliant card programs quickly, without needing their own e-money licence or direct scheme membership.

What should I look for when choosing a card issuer?

When selecting a card issuer, prioritise regulatory credentials, technical capabilities, and scalability. Look for a Mastercard® or Visa Principal member with PCI DSS compliance and a robust in-house payment platform. The issuer should offer flexible BIN sponsorship options (shared or dedicated) and support multiple card types including prepaid, debit and credit programs. API capabilities are essential for seamless integration, particularly for instant virtual card generation and real-time transaction controls. Edenred Payment Solutions ticks all these boxes, whilst offering modular services that let you choose between full card issuing or card processing models based on your regulatory requirements and desired level of control.

What types of cards can I issue through Edenred Payment Solutions?

Through Edenred Payment Solutions, you can issue a comprehensive range of physical and virtual cards tailored to your business needs. Our platform supports branded physical cards with customised designs, instantly generated virtual cards (single-use or reloadable), and tokenised cards for digital wallets including Apple Pay, Google Pay, and Mastercard Click to Pay. We offer flexible BIN sponsorship for prepaid, debit, and credit card programs across multiple use cases. Whether you need corporate expense cards with spending controls, instant payout cards for insurance claims, cards embedded within BNPL checkout flows, or multi-currency cards for spending abroad, our configurable building blocks adapt to your specific product requirements.

What's the difference between your card issuing and card processing models?

Our card issuing model provides everything you need for a fully compliant card program, including licences, BIN sponsorship, regulatory support, balance ledger management and transaction authorisation. You operate under our e-money licence using an agent model. Our card processing model gives you more flexibility if you have your own regulatory authorisation. You maintain control of balance management and authorisation checks whilst we handle the technical complexity through our robust in-house payment platform. Both models offer delegated authorisation features so you can add custom controls through our API.